don't major in minor things

keep things as simple and direct as they can possibly be

good day friends,

if you try to teach yourself diy kwant trading from stuff people write on the internet, you’re going to waste a lot of time majoring on minor shit.

i see it on twitter all the time.

well-meaning beginner traders are spending time worrying about stupid shit that will never work in a million years.

or they’re spending time on niche inference or portfolio construction techniques that are only, at best, relevant at scale.

you don’t wanna worry about anything other than:

finding a real thing that makes things mispriced (i’ve written tons about this)

model that thing as simply and directly as you can.

. . .

and for the second point, the simplest, closest-to-hand tool for the job is what you want.

need to normalize a bunch of different asset returns so they’re comparable?

of course you do. that’s a sensible thing. you can’t really compare retardio and bitcoin moves.

start with normalizing by recent volatility.

and don’t reach for some fancy forecast you need to fit.

use recent realized vol, estimated in a simple easy way, over an intuitively sensible period, after considering what effects you’re looking for.

need to smooth something?

good. that’s important in lots of ways. not least that it’s incredibly expensive to trade something that’s jumping around all over the place.

but there’s no need to get fancy.

you want something where it’s easy to reason about how old information is expiring and new information is arriving.

nothing flash.

reach for a rolling mean/median or exponential smoothing first.

and honestly you probably don’t ever need to go beyond that.

need to reduce trading?

yeah, we all do.

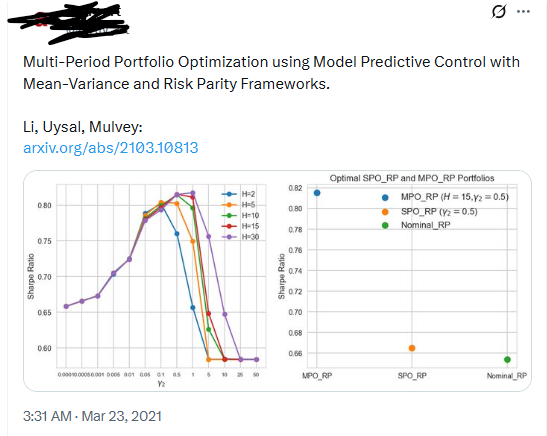

but don’t suddenly start reading about multi-period optimization or some new-fangled thing.

focus on the simple causes first: can your signals be smoothed more? are your risk estimates as stable as they can be?

then maybe you can incorporate some simple heuristics, like a simple no-trade barrier, to reduce your trading before you get lost in the black hole of portfolio optimizer fukery?

trading processes get complicated and hard-to-reason-about at an alarming rate.

you want to keep things as simple and easy to reason about as they can possibly be.

. . .

have a wonderful day.

beep. . . boop