short scamtrash / long distinguished computer currencies

a short investigation into crypotrash

a good and easy and fairly low turnover trade that works in crypto is:

shorting scammy trashperps

longing large cap crypto against it

. . .

this is a bit like the “quality factor” in equities.

but it works better in crypto cos:

everything is less efficient

we are blessed with many opportunities to find crimey crap-perps.

. . .

much like the quality factor in equities, there is no precise way to quantify whether something is trash.

and the best approach is to find a whole bunch of proxies and jam ‘em together.

. . .

i’ll give you a quick, dead-simple example:

. . .

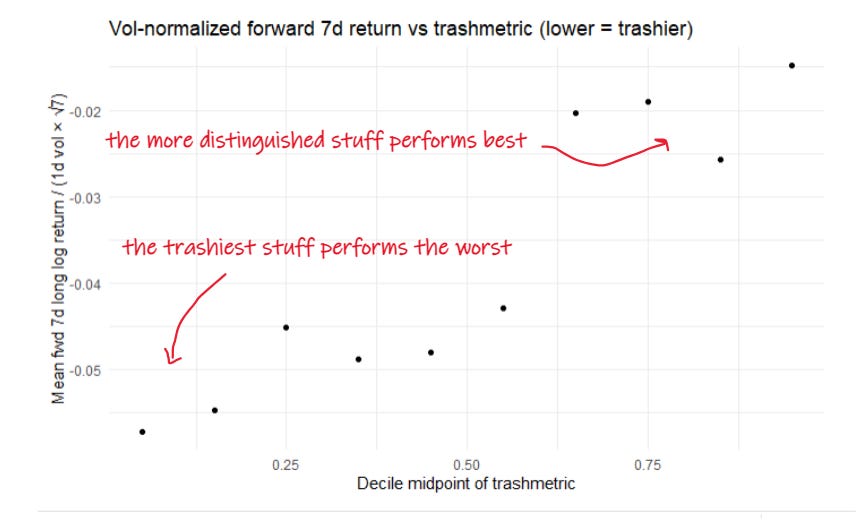

here’s one simple trashmetric, derived solely from trading volume.

we calculate the trashmetric over all perps trading on binance at the start of each week.

then we sort them into then buckets

bucket 1 contains the most trashy stuff

bucket 10 contains the least trashy stuff

finally, we plot the mean total volatility-adjusted log returns (from price change + funding) for each bucket over the following week.

we see:

the trashier the thing, the worse the average returns

the more distinguished the thing, the better the average returns.

consistent with what we see in stocks, but a little more obvious.

. . .

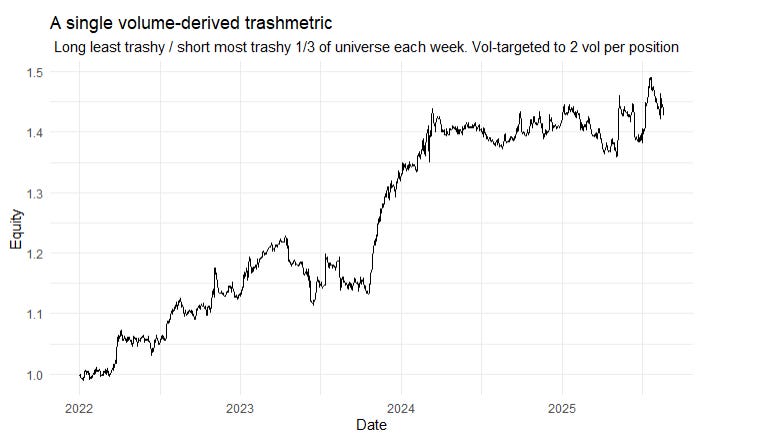

we can simulate what it would look like to trade naively.

each week we simply wanna be:

be long the 1/3 of the universe that is least trashy

be short the 1/3 of the universe that is most trashy

targeting each position to 2 vol (annualised)

. . .

it’s a very simple strategy that only requires you to trade once a week.

and you can easily improve it, with a little creativity, by adding more ways to estimate trashiness.

think about the kinds of things that would indicate “trashiness”:

instability of various time series characteristics

size

liquidity

etc.

and jam them all together into a single metric of trashiness to sort by (or weight positions in proportion to.)

. . .

you can also improve it by being a little smarter than this about portfolio turnover and trading costs.

. . .

allow me to elaborate on:

what this simple example is

how you would trade it

how to be smart about minimizing trading costs in a very simple way

how to look for other ways to quantify trashiness to improve the trade.